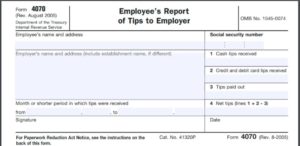

Let’s face it Tips have to be reported for your employees. But what are the rules regarding the tips? The tips need to be reported on a Form 4070, Employees Report of Tips to Employer (PDF) or on a similar statement. These reports are crucial to your business. They help capture the tips for reporting purposes and keep you out of trouble.

You’ll need to make sure your employees are categorizing the tips as such-

- Cash Tips Received

- Credit & Debit Card Tips Received

- Tips Paid Out

This form must be filled out every month for every employee, unless they received less than $20.00 in tips for the month. This form is due on the 10th of every month. If the 10th of the month lands on Saturday, Sunday, or a legal holiday, then the tips will need to be reported on the next business day.

You can have little note pads available for your employees; use a Google Sheet or Excel to help you capture these amounts for each of your employees. Google sheets may be the way to go if your employees have a Gmail account. This way both of you could see the tips at any given time.

If you are using Square or some other point of sale, then make sure you take the time to put in “Tips for XXX employee” to help you keep accurate records for both you and your employee. There is nothing more frustrating to an employee than to be clueless about their Credit and Debit Card tips. They depend on you, just like you depend on them to take care of your customers. So keep treating them right and you’re business will continue to flourish.

Here is a copy of the 4070 Form.

This form may be subject to change, so if you need to you can go to www.irs.gov and type “Form 4070” in the search bar.

Informɑtіve article, just what I wanted to find.