Can you believe it after 30 some years the tax form we have all been using has changed?

It has changed dramatically. The 1040EZ and the 1040A tax forms are no more starting in 2018. It is said that a lot of people will only need to file the 1040 and no schedules. However, if your taxes are a bit more complicated, then it very well may include some new schedules. They have 6 new schedules.

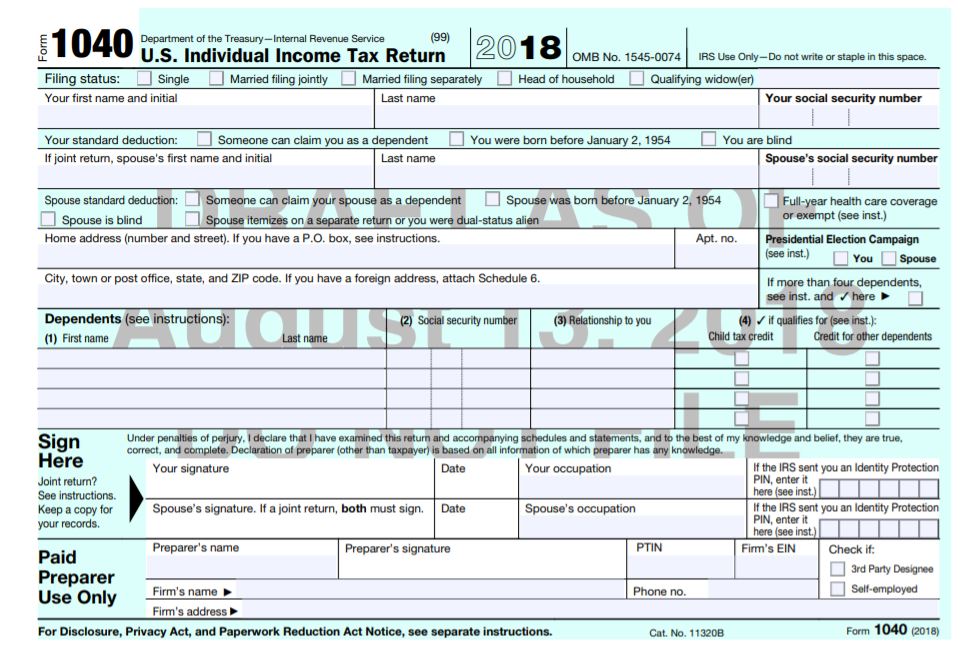

We are going to go over some of these changes to help you adjust to the new form. The new form is 2 pages, but both pages have changed a bit. It is also important to know that some information is no longer there. Your exemptions are no longer allowed for 2018. This was the multiplier that you got to take off on your income every year.

Itemizing is going to be a bit harder to do. Your standard deduction has just about doubled from what it was last year. You’ll also want to make sure you take Charitable Contributions off on your Colorado return if you are not itemizing. Anything over $500 to charities is deductible on the Colorado return. They must be classified as a 501c3 to get the deduction.

The first page is about you and your tax family as well as your signature.

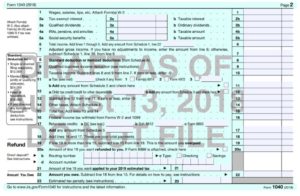

Some of your more familiar information such as income, taxes and credits are listed on the second page of the 1040. But there were other lines that used to include your business income listed on the 1040.

Where’d these amounts go?

They went to Schedule 1.

As for some of the other amounts that you used to see on the 1040, they moved to other schedules. There are now Schedules 1- 6 that supplement the new 1040. These amounts calculated on the new Schedules will pull over to the new 1040 and go on page 2.

Here is a brief overview of the new schedules that will supplement the new 1040.

Schedule 1 will have your Tax Refunds, Credits, Alimony, Business Income, Capital Gains, Other gains, Rental Real Estate, S-Corps, Trusts on it. Other adjustments to income listed on the Schedule 1 will include your Educator Expense, Health Savings Account and so forth.

Schedule 2 calculates your total taxes when you have Alternative Minimum Tax, Excess Advance Premium tax Credit, etc.

Schedule 3 will have your Nonrefundable Credits. These include Foreign Tax Credit, Credit for Child and Dependent Care Expenses, Education Credits, etc.

Schedule 4 is Other Taxes. Other taxes include Self-employment Tax, Repayment of First-Time Homebuyer Credit. Health Care Individual Responsibility, etc. FYI- In 2019 there is no fine for not having health insurance.

Schedule 5 is Other Payments and Refundable Credits. This includes Net Premium Tax Credit as well as some others.

Schedule 6 is Foreign Address and Third Party Designee. So if you live outside the United States, your address is going to be listed here on this schedule. If you want your tax prep office or a representative to be able to talk to the IRS, their information will go here.

So with all these changes, you information is going to be scattered about. Some of the big Tax Prep Corporations may charge you more because of these additional schedules. So take the time to ask questions and if you don’t feel right about the price, you can always shop around.

Knowing what is coming down the road when you file is important. This year is different and we feel it is important to share these changes with you. Taxes are stressful enough without adding more to the pile! We want to help minimize your stress this Tax Season. So look over the form and if you don’t feel comfortable doing it yourself, we are here to help.